how to pay meal tax in mass

Please enable JavaScript to view the page content. Businesses that collected less than 150000 in regular sales and meals.

Survey Finds Solid Support For Millionaires Tax Among Would Be Voters The Boston Globe

Massachusetts local sales tax on meals.

. The meals tax rate is 625. The maximum tax that can be enacted on meals in. Small businesses in Massachusetts can defer paying regular sales meals and room occupancy taxes until May 2021.

Sales of meals to Harvard faculty and staff are taxable. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Bier Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

Click here to read the Special Legislation to enact the Meals Tax Click Image to EnlargeMonth Collected by RestaurantsMeals Tax AmountInterest Earned on FundAppropriated at Town. Please enable JavaScript to view the page content. The local meals tax does not increase restaurant bills significantly.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. The meals tax rate is. Your support ID is.

The maximum tax that can be enacted on meals in. Meals are sold by. Sales of meals to Harvard students are tax-exempt if.

On a 100 restaurant check a customer would pay an extra 75 cents. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT.

Your support ID is. The Commonwealth of Massachusetts allowed municipalities to levy this 075 percent tax in an addition to the state-levied 625 percent meals tax in order to help offset. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

A Haverhill Massachusetts Meals Tax Restaurant Tax can only be obtained through an authorized. Generally food products people commonly think of as. In Massachusetts there is a 625 sales tax on meals.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. How to pay meal tax in mass Tuesday May 3 2022 Edit.

Massachusetts Sales Use Tax Guide Avalara

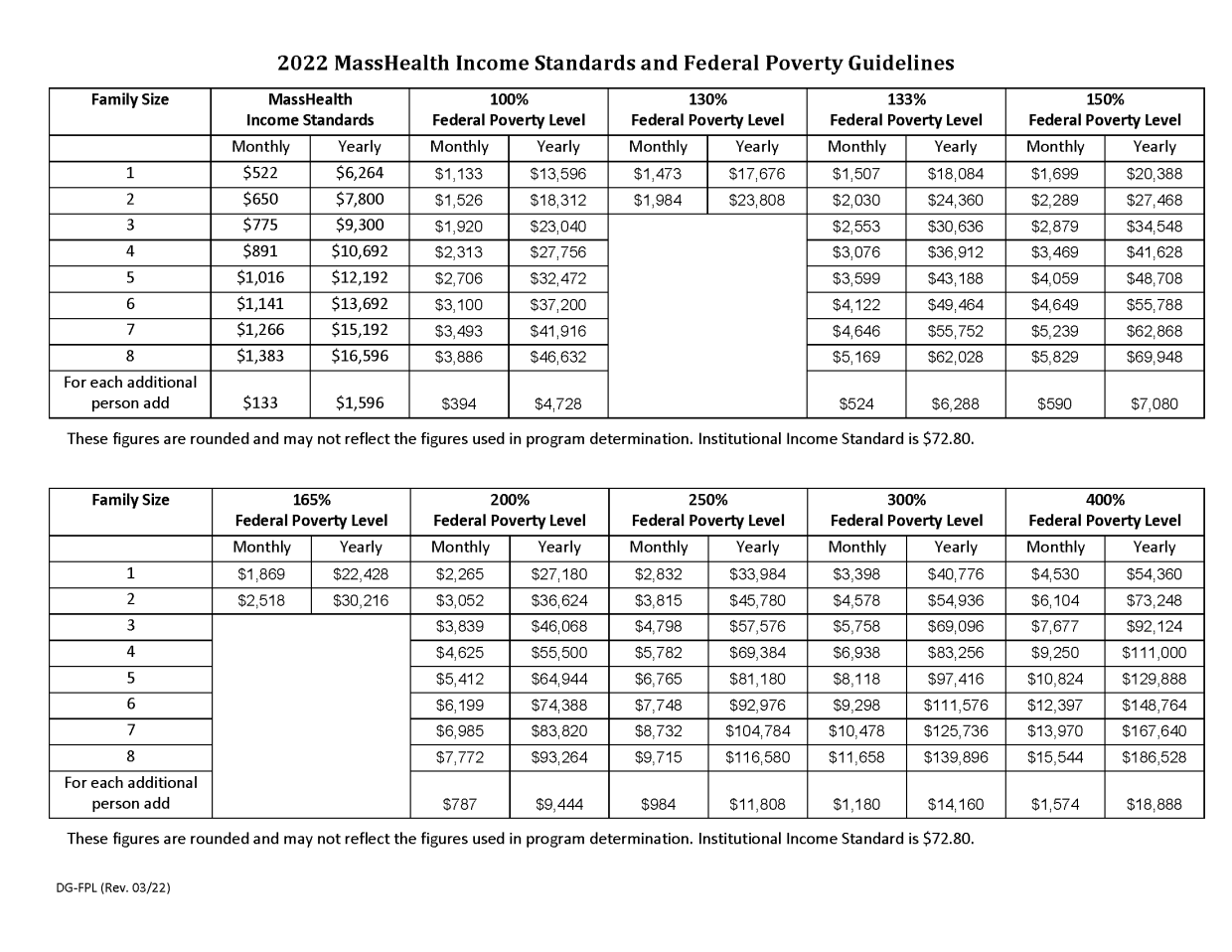

Program Financial Guidelines For Certain Masshealth Applicants And Members Mass Gov

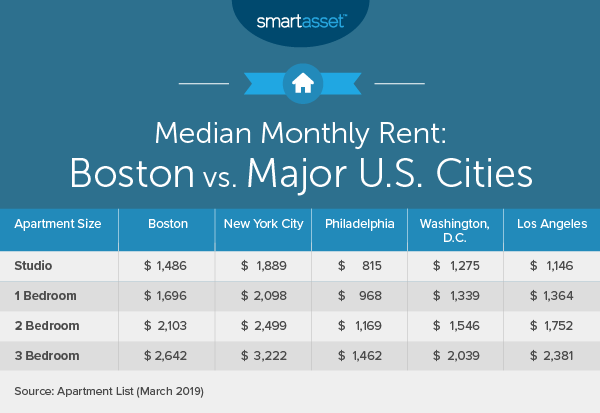

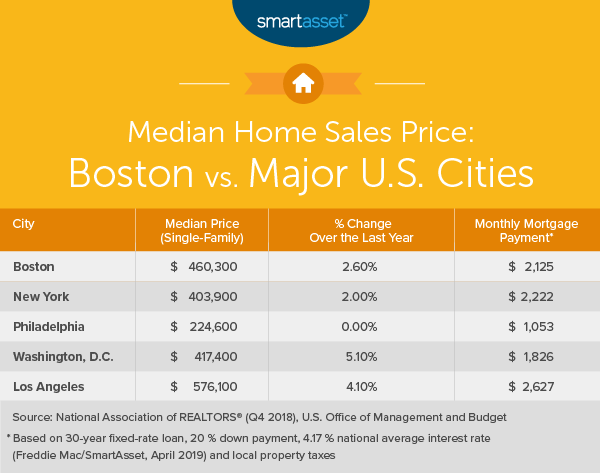

The Cost Of Living In Boston Smartasset

Sales Tax Holidays Politically Expedient But Poor Tax Policy

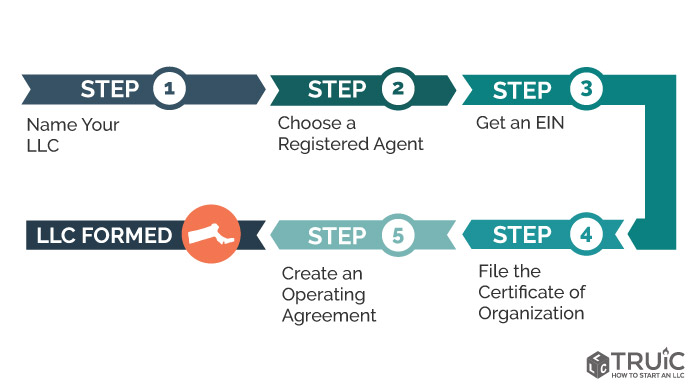

Llc Massachusetts How To Start An Llc In Mass Truic

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Sales Tax By State Is Saas Taxable Taxjar

Massachusetts Sales Tax Small Business Guide Truic

Sales And Use Tax For Businesses Mass Gov

Massachusetts Sales Tax Handbook 2022

Tax Free Days In Massachusetts Tips Local Guide

Massachusetts Sales Tax Guide And Calculator 2022 Taxjar

Online Bill Payments City Of Revere Massachusetts

How Do State And Local Sales Taxes Work Tax Policy Center